The place will tomorrow’s income come from?

If you have a look at the historical past of practically any long-term, profitable firm, you see occasional shifts in product and repair choices. IBM is a superb instance. IBM is 112 years outdated. For many of that point, IBM was thought of a producer. Their merchandise had been machines that might tabulate, kind, and maintain information. Many of those machines had been cutting-edge. IBM’s electrical typewriters used a rotating ball to strike the ribbon and paper, as an alternative of a lever. The end result was a quicker typing tempo and a extra versatile feel and look from kind — you would swap out the ball for a special font.

If you have a look at IBM at the moment, you don’t consider manufacturing. Their worthwhile merchandise have modified over time. These shifts and “enterprise dangers” give firms larger resilience and longevity by permitting the corporate to overlap core enterprise capabilities with the brand new enterprise alternatives that exist exterior the core enterprise. Many instances these fringe companies turn into core companies, then, if the corporate is round lengthy sufficient, these core companies are sometimes changed by different up-and-coming alternatives. Look how far cloud computing, automation, and AI are from desktop calculators and punch card tabulators.

Some insurers would possibly argue that their core worth proposition of danger merchandise won’t ever change. However in at the moment’s world, “by no means” could be overturned in a second. Main insurers ought to all the time maintain an eye fixed out for worthwhile alternatives on the periphery. Is there a brand new revenue middle ready within the wings to your group to choose it up?

Indicators from the perimeter

At Majesco, we intently look at buyer developments that can have an effect on insurance coverage’s product choices and its fringe alternatives. Via our market surveys, we establish areas the place there are gaps between what particular person and enterprise prospects need and what insurers are at present offering. A few of these gaps are giant. They symbolize alternatives which might be too huge to overlook. For an in-depth have a look at these developments, be sure you learn Bridging the Buyer Expectation Hole: Property Insurance coverage.

For at the moment’s dialogue, we’ll concentrate on three areas of value-added service alternative as recognized by Majesco analysis:

- Preventive companies (Business and Particular person P&C)

- Utilization-based supplemental protection (Business and Particular person P&C)

- Providers directed to particular life-style wants (Particular person P&C)

Preventive Providers (Business/SMB)

Danger is rising. In keeping with McKinsey’s 2023 insurance coverage report, a mix of things goes to push insurers into new market territories.[i]

- Elevated CAT occasions within the US (Up 50% within the 2017-2023 timeframe from the 2007-2017 timeframe),

- Elevated cyber dangers, and

- The necessity for larger relevance with their choices

Both insurers and reinsurers have to gear as much as tackle extra danger, or they need to innovate round serving to prospects scale back or eradicate danger. Or possibly it’s all the above. Right now’s elevated catastrophes, inflation, unstable market surroundings, and stress on profitability demand a larger concentrate on preventable losses and higher outcomes by underwriting profitability, proactive danger mitigation to reduce or eradicate claims, and enhanced buyer experiences.

Enterprise prospects need confidence and safety that goes past the loss-recovery contract. Whereas insurers are centered on how they’ll higher assess danger, many are actually increasing to additionally concentrate on the prevention of losses and creating danger resilience for purchasers.

Prevention is the way forward for insurance coverage. Whereas prevention companies by surveys and schooling aren’t new within the insurance coverage business, the methods to establish and forestall danger are altering. Each know-how or value-added service that aids in prevention and danger mitigation is a know-how that can give insurers a secure basis upon which to develop, even in unstable instances. A prevented declare additionally occurs to be the last word buyer expertise.

Majesco helps insurers to establish preventable dangers and reduceable impacts by each business mindsets and new applied sciences that may help. We started by wanting on the disparities between SMB and Insurer curiosity particularly applied sciences and companies.

Business Property SMB – Insurer Gaps

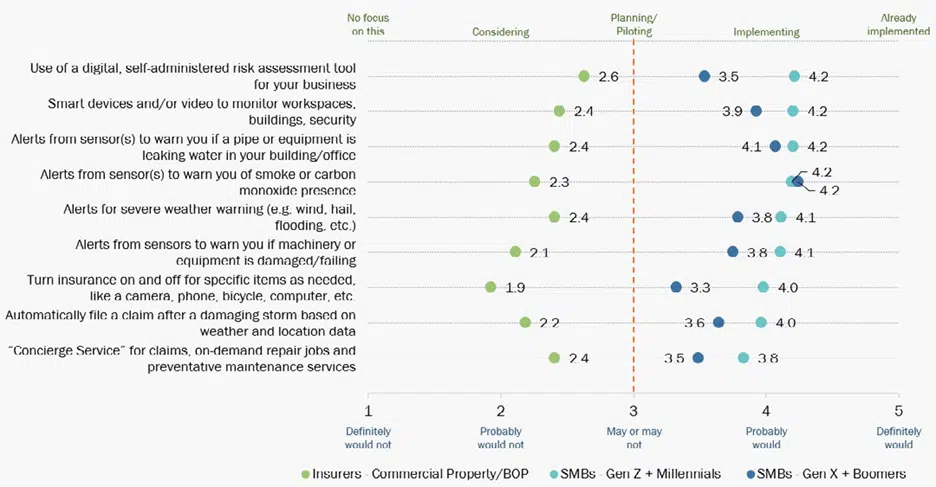

In keeping with Majesco surveys, there are giant gaps between what SMB prospects need and what insurers are or aren’t delivering, with as much as a two-times differential, as seen in Determine 1. Most significantly, that is constant for each generational teams (Gen Z-Millennial SMBs and Gen X-Boomer SMBs), with little differentiation.

Trying on the proper aspect of Determine 1, we see the SMB propensity to make use of specific preventive applied sciences and companies. These embody Safety monitoring with sensible units or video, plus sensors and alerts for smoke/CO, water leaks, gear failure, and extreme climate. Objects similar to these promote security and supply peace of thoughts by serving to to keep away from or decrease danger.

These companies have among the many highest ranges of curiosity for each segments. Each teams’ demand for companies is to assist make their lives simpler with excessive curiosity in digital property self-assessment instruments, automated claims FNOLs primarily based on extreme climate and site information, and concierge service for repairs and preventative upkeep. For SMBs, this turns into an actual worth with all of the pressures they face each day.

Think about automated and concierge companies, for instance. Insurers have a chance to repair one challenge — the SMB time crunch — whereas addressing main danger points, similar to preventive upkeep that may save claims. Worth-added companies like these can add worth to each the policyholder and the insurer.

The applied sciences and information that energy value-added companies exist at the moment and plenty of of them are operational. For instance, Majesco’s LossControl360 makes use of AI and machine studying to higher assess danger and supply a report of areas to scale back it. Insurers can use the huge loss management survey information Majesco has together with third-party information to make use of our Property Intelligence AI mannequin to boost underwriting, and loss management assessments after which leverage the outcomes to speak and educate prospects on understanding and managing their danger.

Determine 1

Buyer-Insurer gaps in value-added companies for business property insurance coverage

Utilization-Based mostly Insurer Gaps for All P&C Carriers

Each private and business P&C are affected by gaps that may be remedied by usage-based merchandise for all sorts of property. One frequent challenge regards insuring objects which might be seldom used, similar to leisure automobiles, small (however costly) private objects, similar to images gear, or different leisure gear, similar to bikes and scooters. For SMBs, these would possibly embody items of not often used, however essential gear, rented automobiles specialty, event-driven initiatives that will sometimes fall below the realm of E&S insurance policies. Wherever there’s a short-term, short-term danger, there’s the chance for a brand new product and income.

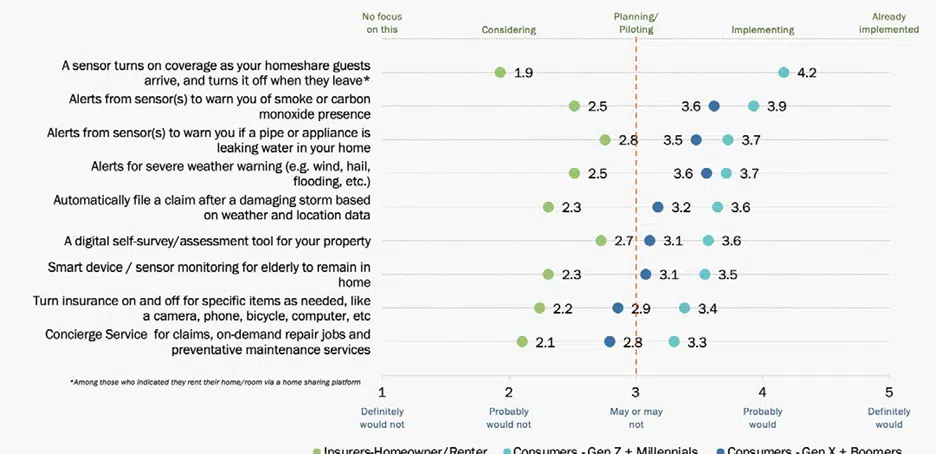

Taking a look at each Determine 1 and Determine 2, we get a way that the best gaps happen on most of these objects, the place people and SMBs need protection, however can’t abide by the price of a full-time coverage. Insurers would love the extra premiums, however their methods aren’t all the time constructed to deal with insurance coverage that may be turned on and off. This looks like a priceless alternative for insurers to shut safety gaps and start serving a rising market. It makes essentially the most sense to start providing these merchandise to present policyholders, however with expertise, these merchandise are additionally ripe for placement by channel companions.

Private Property Client – Insurer Gaps

Folks need security they usually need their lives to run easily, amid an unpredictable world. They’ve life-style wants. They may pay for companies to assist them keep the established order regardless of new challenges. That is the candy spot of value-added companies. To verify that present insurance-related applied sciences are desired by prospects, Majesco surveyed shopper sentiment. Are these applied sciences viable for adoption? Will they be accepted?

In our shopper analysis, we see a generational alignment in value-added companies within the house owner/renter insurance coverage area, possible pushed by their top-of-mind points (Determine 2). Prospects worth security and peace of thoughts from alerts and monitoring units/companies like smoke/CO and water leak sensors, dwelling monitoring for aged members of the family, and extreme climate alerts. These choices have among the many highest ranges of curiosity for each generational segments.

Particularly, the monitoring of aged members of the family leverages sensor know-how to assist maintain them of their houses somewhat than a nursing dwelling or assisted dwelling, serving to to handle their monetary top-of-mind points. The US inhabitants is growing old, which goes to create contemporary buyer wants and insurance coverage alternatives. In October 2023, the U.S. Census Bureau launched a report that roughly 4 million households with an grownup age 65 or older, “had problem dwelling in or utilizing some options of their dwelling.” Nationally, only a few houses are ready to accommodate an growing old inhabitants. For instance, solely 19.6% of houses in New England could be thought of “aging-ready.”[ii]

Because the inhabitants ages and as middle-aged caregivers are referred to as upon to make choices that can profit the extent of take care of an older dad or mum, these prospects shall be looking for protecting and preventive companies that could possibly be thought of fringe companies — however could turn into core revenue facilities because the inhabitants continues to age. Dwelling retrofitting for security, including dwelling sensors and cameras to enhance ranges of care within the dwelling, and creating strategies for watching over water and electrical harm (frequent points for the aged of their houses). And that is only for elder care. If insurers contemplate further life-style elements, a complete array of attainable services and products begins to take form.

Ease of automated claims FNOLs primarily based on climate and site information, automated cyber safety monitoring, and digital property self-assessment instruments all present self-service capabilities more and more demanded by prospects. A world of danger incorporates fear. Insurers can ease worries with value-adds.

For instance, concierge companies for repairs and preventative upkeep are additionally of excessive curiosity amongst shoppers. They know the worth of their spare time and plenty of of them don’t wish to spend their spare time fixing issues. Danger prevention and mitigation of their most useful property – their dwelling and private property — is a excessive precedence.

The breadth and powerful curiosity in these value-added companies provide insurers a chance to deepen buyer relationships whereas creating potential new income streams to offset the curiosity in personalised pricing. However insurers want to maneuver nicely past consideration into motion…by delivering value-added companies.

Determine 2

Buyer-Insurer gaps in value-added companies for private property insurance coverage

Your Entrepreneurial Enterprise

Your enterprise has a core services or products. It’s the factor you do nicely, and it gives income over the lengthy haul. These with an entrepreneurial spirit additionally go after the services and products that encompass the periphery of what they do. They see alternatives on the perimeter. They break down partitions of conference to realize entry to new markets with contemporary concepts.

The place is your subsequent revenue middle? Majesco has lately rolled out a brand new and expanded line of insurance-focused merchandise, similar to our P&C Clever Core Suite, Majesco Loss Management, Majesco Property Intelligence[DG1] , and Majesco Copilot, developed utilizing Microsoft’s cutting-edge AI fashions. They’re prepared to assist insurers transfer into innovation’s quick lane.

Construct resilience into your framework by including value-added companies to your combine. Contact Majesco at the moment and be sure you attend our upcoming developments webinar, Majesco on the Forefront: Methods and Improvements Shaping the Insurance coverage Business.

[i] Javanmardian, Kia, James Polybank, Sirus Ramezani, Shannon Varney, Leda Zaharieva, World Insurance coverage Report 2023: Increasing business P&Cs market relevance, McKinsey & Co. March 2023

[ii] Census Bureau Releases New Report on Growing older-Prepared Houses, October 10, 2023, US Census Bureau

[DG1]Yperlink these