Mumtalakat is already the firm’s largest shareholder and taking complete ownership could help attract large OEM partnerships

December 21, 2023 at 07:57

The McLaren Group will soon fall under complete ownership of Bahrain’s sovereign wealth fund based on a new report.

Bahrain’s wealth fund, Mumtalakat, is currently the British carmaker and racing outfit’s largest shareholder with a roughly 60% stake. It is now being reported the fund is inching towards a deal with McLaren’s remaining minority shareholders that will involve them converting their equity into warrant-like instruments and providing the fund with full ownership of the brand.

Sky News reports that these contracts offered to minority shareholders will not be classed as shares but they will have the right to benefit from important liquidity events like a potential initial public offering of McLaren. The agreement could be announced as soon as this week.

advertisement scroll to continue

Read: Latest McLaren Artura Recall Is Over A Fire Risk From Bad Fuel Pipe

It is understood that the firm’s complex capital structure has deterred major car manufacturers from partnering with it and Sky News suggests that a more simplified ownership structure could “pave the way for a technology partnership with an OEM in the coming years.”

Mumtalakat has grown its stake in McLaren throughout this year. It has already acquired the shares previously held by Saudi Arabia’s sovereign wealth fund as well as U.S. financial investor Ares Management.

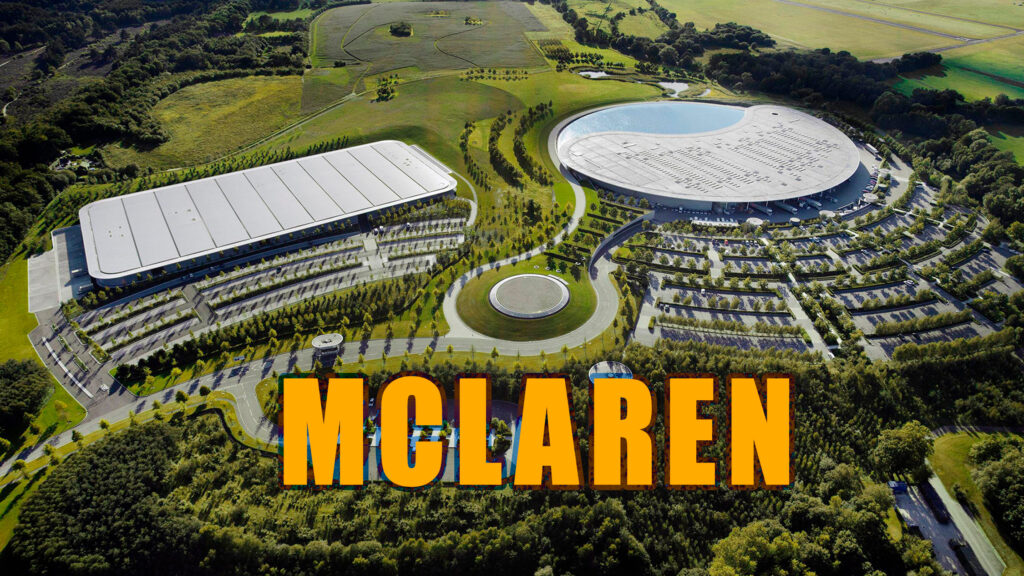

The last three years have been quite a tumultuous financial period for the carmaker. Not only did the Covid-19 pandemic prompt it to cut jobs but it was forced to sell a major stake in its McLaren Racing division while also completely off-loading McLaren Applied Technologies. It also sold its famed headquarters in the UK for $237 million and is now leasing it as part of a 20-year deal.

Earlier this week, McLaren updated the GT with the launch of the new GTS. This refreshed model has slightly more power than its predecessor, weighs less, and has an even more advanced suspension system.